Never hesitate to follow up with your carrier about the status of your insurance policy, and be sure to request a copy of the new insurance policy contract if you do not receive one when it is approved. Otherwise, you will lose coverage and be at risk for any accidents that occur while you are uninsured, as insurance binders are only meant to serve as temporary coverage. What to do after your insurance binder expiresĪfter your insurance binder expires, you should verify with your insurance company that your new policy has been issued. Insurers may send insurance binder letters via mail, but if you need proof of bind coverage immediately, you can request electronic delivery by email or fax. As a result, insurance binders are typically issued for 30 days but can last as long as 90 days. However, depending on your circumstances, such as your driver profile or the particular home you're buying, it may take several weeks for an insurance policy to be approved. Today, some insurance policies can be issued online within minutes. Similarly, a lender may require an auto insurance binder to approve an auto loan on a new car. When closing on a house, a homeowners or home insurance binder helps finalize your mortgage by providing temporary evidence of insurance.

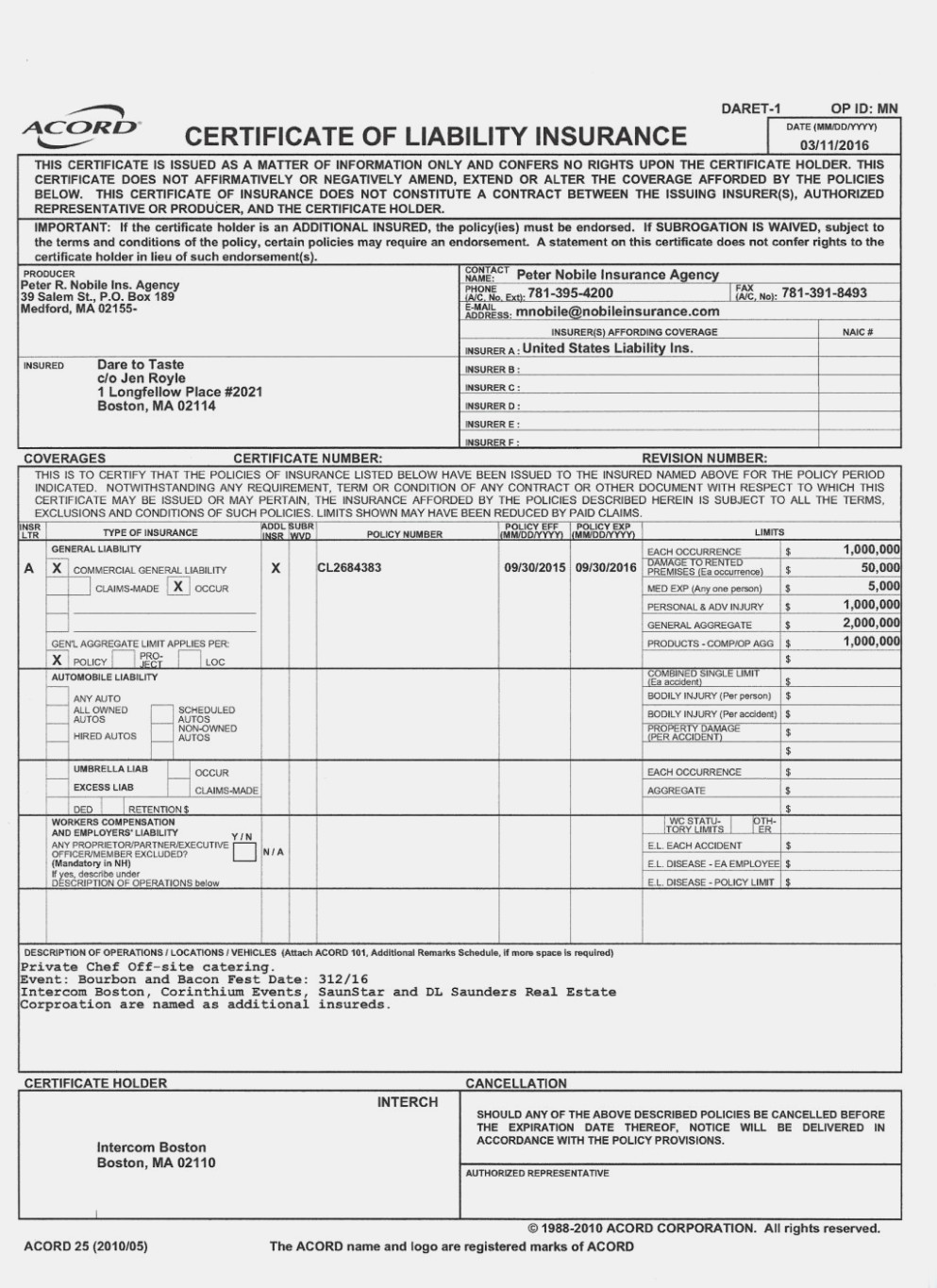

As a result, you may hear an insurance binder referred to as an ACORD binder or ACORD insurance binder.Īn insurance binder may also sometimes be referred to as: Many insurance binder forms or templates are issued by the Association for Cooperative Operations Research and Development (ACORD), a nonprofit that provides insurance companies with data and implementation standards. Upon expiration, the insurance binder will no longer provide you with insurance coverage. The expiration date of an insurance binder is usually within 30–90 days of when it was issued.

It's simply a few pages of legal paperwork that identifies all the terms and conditions of your temporary insurance contract. The insurance binder will not look like a physical binder. It provides proof of insurance for a certain period, usually until a standard policy is issued. An insurance binder is a temporary insurance contract that provides fully effective insurance coverage while you wait for the formal issuance - or, in some cases, rejection - of an insurance policy.Īn insurance binder is a written legal agreement between you and the insurance company.

0 kommentar(er)

0 kommentar(er)